NVIDIA Tells Retailers To Sell To Gamers, Not Cryptominers As GPU Shortage Causes Extreme Price Gouging

There are many examples today of how PC gaming is flourishing better than ever. You only have to look towards the eSports market to understand how alive and well the ecosystem is. Games like PUBG are being played by the millions, and naturally, that's making many more want to explore the PC gaming world and the components of a killer gaming rig that are the tools of the trade.

Typical crypto-mining rig - one guess as to why GPU prices are so high right now...

This should be a time when every hard-core PC gamer should be gloating and grinning from ear-to-ear. PC gaming was never dead; it's actually picking up steam in a big way and so is the DIY PC build market. However, there is one thing that's throwing as a wrench in many a PC builder's gears currently and that's pricing. There's no way around it and it's downright painful right now. Cryptocurrency mining isn't the only reason for the currently high cost of a new gaming PC, but it's the one dynamic acting as a true roadblock to people building a new gaming PC themselves. It's also serious motivation to consider a pre-built system, even if you can build one yourself.

Amazon Pricing - GeForce GTX 1080

Memory prices are getting more wallet-punishing right now as well, but not to the extent of GPUs. A GeForce GTX 1080 from NVIDIA carries an MSRP of $499, and there have been many occasions in the past where cards at that price could be found on etailers like Amazon and Newegg. Today, those same cards can cost over $1,000. Meanwhile, GeForce GTX 1080 Tis now can only be found for roughly $1,250.

Here's a bit more proof of how crypto-mining is hurting PC gaming...

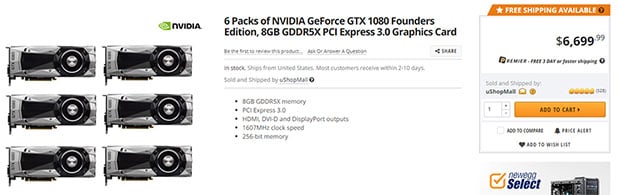

NewEgg's Six-Pack Of GTX 1080s For Only $6700?

That's not one, not two (for SLI), but six GeForce GTX 1080 cards priced at $6,700. That's a $3,700 premium over buying the cards at what NVIDIA markets them for an MSRP. We're actually in a strange period where Tech reviewers essentially have no reason to even review GPUs currently and subsequently recommend any, due to complete lack of value proposition at these prices. We have no idea how long this gouging is going to last, but there's at least one manufacturer apparently trying to do something about it and that's NVIDIA.

You'll have to excuse our weak German translation skills. Regardless, if information recently published from tech site ComputerBase is correct, it seems at least in Europe, NVIDIA is directly asking etailers to limit the number of cards that can wind up in any one customer's hands. The suggested limit is two, which given the current situation seems fair. But is it enough?

We'd like to go back to the time where a $100 premium on an RX Vega 64 seemed high.

It's likely, that if someone wants to mine bad enough, they're going to do whatever it takes to get the hardware they need. There's a reason these GPUs are priced so high; some people are actually paying those prices. As an etailer, this situation must feel like a dream of pure greed, but at the same time, it's an insult to pretty much every PC gamer that's ever been a customer. And god help the newbies looking to finally join in on the fun and build their own rig. Perish the thought, but it's probably enough to make some gamers want to stick with consoles for now. #PCMasterRace

Ultimately, NVIDIA can request whatever it wants, but it's up to etailers and brick and mortar retailers to actually enforce those suggestions. Some may choose not to, and really, it's hard to blame them with profit margins historically always tracking the supply/demand curve. However, pricing products at sometimes many multiples over what they should be, just simply taking advantage of consumers in a bubble market like this, won't soon be forgotten.

Maybe etailers would be better served in the long run if they thought about ways to identify true gamer demand and cater to that specifically in some way, at least from a pricing standpoint. Think about it.

Update: 1/21/2018 - This article has been updated with additional editor commentary and pricing citations.