When PC gaming saw a resurgence, NVIDIA made bank. Then when cryptocurrency mining on GPUs became a popular thing, NVIDIA made more bank. And now? NVIDIA is riding the next wave in tech, which is artificial intelligence, to its biggest earnings ever at $35.08 billion in revenue for yet another record quarter bolstered by its data center division. That's a remarkable

17% jump sequentially and close to double (94%) the revenue NVIDIA generated a year ago ($18.1 billion).

What NVIDIA has been able to do is nothing short of remarkable, and it shouldn't be taken for granted. Just look at Intel, the x86 chip Goliath and the

situation it finds itself in, as an example at how the biggest and longest-standing companies in tech can and do struggle at times. NVIDIA, however, is thriving again and again, quarter after quarter, as market trends shift and that's no easy task.

"The age of AI is in full steam, propelling a global shift to NVIDIA computing," said Jensen Huang, founder and CEO of NVIDIA. "Demand for Hopper and anticipation for Blackwell—in full production—are incredible as foundation model makers scale pretraining, post-training and inference."

"AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure," Huang added.

As a result, the data center continues to be NVIDIA's top money maker by a mile, pulling in $30.77 billion in the third quarter. That's a chunky 17% gain compared to the previous quarter (same percentage as the increase in overall revenue), and a huge 112% leap from the same quarter a year ago.

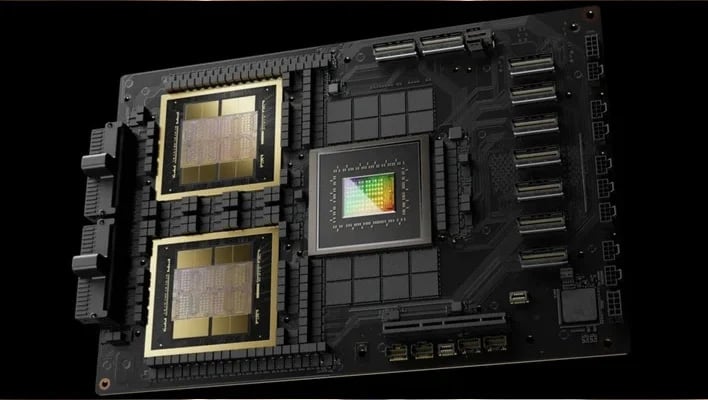

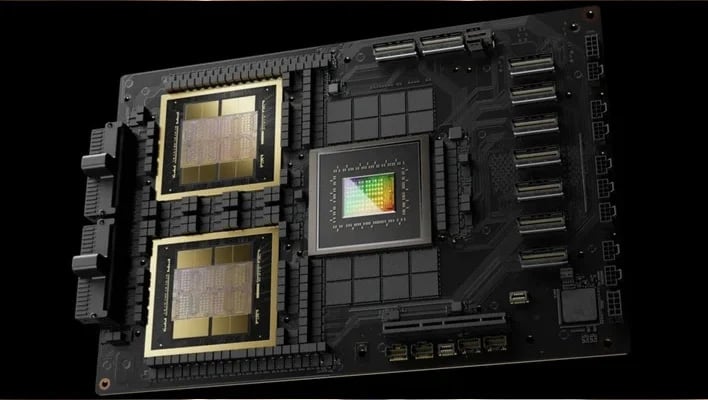

NVIDIA Blackwell superchip

NVIDIA Blackwell superchip

During an earnings call, NVIDIA's Chief Financial Officer and Executive Vice President, Colette Kress, said demand for Hopper is "exceptional" with sales increasing "significantly" last quarter. Kress also reiterated Huang's statement in saying that "Blackwell is in full production after a successfully executed change," noting that NVIDIA has shipped 13,000 GPU samples to customers in the third quarter. That includes the first Blackwell DGX engineering samples to OpenAI. NVIDIA also recently unveiled its quad-Blackwell dual-Grace

GB200 superchip.

"From liquid-cooled to air-cooled, every customer is racing to be the first to market. Blackwell is now in the hands of all of our major partners, and they are working to bring up their data centers. We are integrating Blackwell systems into the diverse data center configurations of our customers. Blackwell demand is staggering, and we are racing to scale supply to meet the incredible demand customers are placing on us," Kress added.

Meanwhile, NVIDIA's gaming division remains a distant second to the data center, though is still raking in billions every quarter. Specifically, it generated around $3.3 billion in the third quarter, which is up 14% sequentially and 15% year-over-year. And that's while dealing with apparent supply constraints, which NVIDIA expects will lead to a sequential decline in sales in the fourth quarter.

"Our gaming right now from a supply, we're busy trying to make sure that we can ramp all of our different products. And in this case, our gaming supply, given what we saw selling through was moving quite fast.

Now, the challenge that we have is how fast could we get that supply getting ready into the market for this quarter. Not to worry, I think we'll be back on track with more supply as we turn the corner into the new calendar year. We're just going to be tight for this quarter," Kress said.

It's no secret that Kress is referring to the upcoming GeForce RTX 50 series, which NVIDIA is expected to announce at the Consumer Electronics Show in January. In addition to navigating supply challenges, it wouldn't surprise us if gaming sales takes a partial (and temporary) hit resulting from gamers and enthusiasts holding out for next-gen GPUs, but we'll have to wait and see.

Regardless, NVIDIA is seeing

gains across the board, as outlined in the chart above. The company finds itself on solid footing. And looking ahead to next quarter, NVIDIA expects revenue to check in around $37.5 billion, plus or minus 2%.