Twitter Stakeholder Lawsuit Accuses Elon Musk Of Shady Stock Price Manipulation

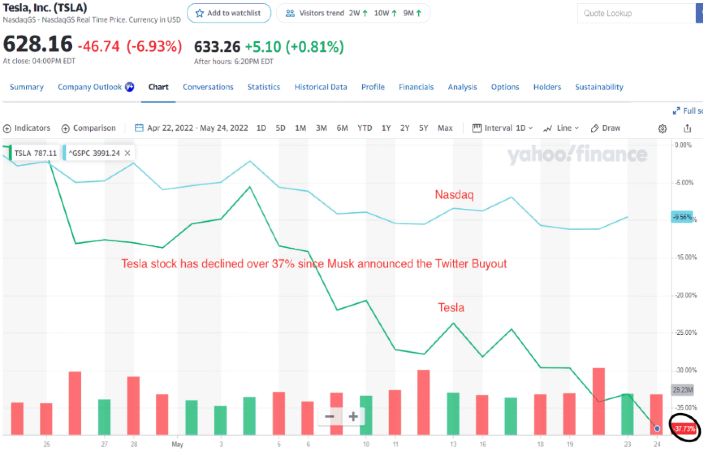

In a lawsuit filed Wednesday in California federal court, Musk is alleged to have faced "a unique and multi-billion-dollar problem" after he pledged his Tesla stock as collateral for a $12.5 billion loan to help finance the Twitter buyout. Since the deal was announced, Tesla stock has remained down and was still off by more than 40% as of the end of trading on Wednesday. Twitter's share price has also dropped more than 12% since the deal was announced. At one point, Musk tweeted that the deal was "temporarily on hold" due to the uncertainty of the amount of bots on the platform.

Musk is alleged to have made statements, sent tweets, and engaged in conduct that was designed to create a cloud of doubt that the deal would actually happen, all in order to drive Twitter's stock price down substantially. It goes on to point out that Musk hoped by bringing down the stock price, he could effectively renegotiate the buyout price by as much as 25%, or back out of the deal completely. If Musk were able to renegotiate at a 25% reduction in price, it would amount to an $11 billion reduction in the buyout price.

Included in the lawsuit are numerous tweets that Musk has sent on his official Twitter account. The tweets include where the billionaire stated that the deal was "temporarily on hold" pending details surrounding the calculation of the actual number of spam/fake accounts on the platform. Legal experts have stated these tweets by Musk may prompt the platform to sue Musk to collect a $1 billion breakup fee or force him to make good on his offer.

In an emailed statement to Law360, Francis A. Bottini Jr., of Bottini & Bottini Inc., counsel for Heresniak, said, "In light of the plunging value of the Tesla stock he pledged as collateral for $12.5 billion in loans, Musk announced yesterday that he has abandoned such loans and is now seeking other investors such as Jack Dorsey to make equity contributions." Bottini added, "Meanwhile, Musk continues to disparage the company he wants to buy for $44 billion in an effort to renegotiate the purchase price."

As far as Dorsey goes, it was announced a couple days ago that the Twitter co-founder is stepping down from the company's board. "As we shared back in November, Jack would be leaving the Board when 'his term expires at the 2022 meeting of stockholders,'" remarked a Twitter spokesperson in a statement to The Hill.

Top Image Credit: Daniel Oberhaus via Flickr