Only the Bureau of Engraving and Printing, a division of the Department of the Treasury, is allowed to print money in the United States. Coming in a close second, however, NVIDIA prints designs primarily for GPU hardware, which might as well be a license to print money in the burgeoning era of artificial intelligence. As such, NVIDIA shared its latest earnings results, which reflect a massive 262% year-over-year gain in quarterly revenue.

More precisely, NVIDIA raked in $26 billion for its first quarter of fiscal 2024, which is also up significantly (18%) from the

previous quarter. The rise in revenue helped boost NVIDIA's net income to $14.9 billion, which is up 21% sequentially and a whopping 628%, compared to the same quarter a year ago. Folks, that's as close as you can come to legally printing money without actually doing so in a literal sense.

NVIDIA's monster quarter (yet another one) is a snapshot of the

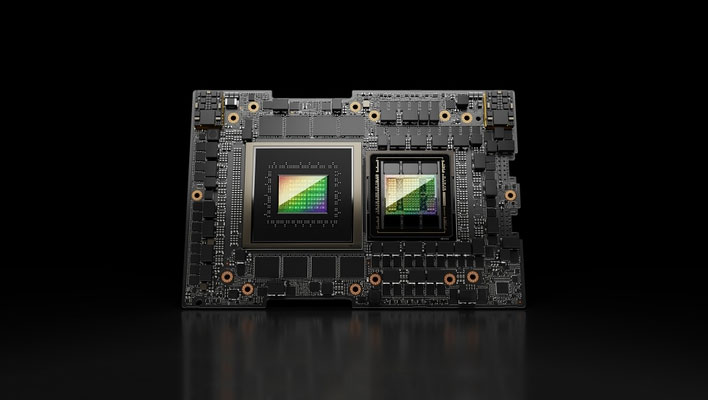

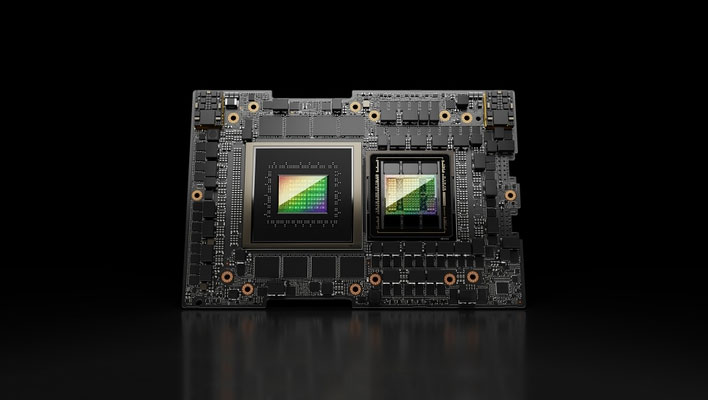

AI craze that's overtaking the technology sector. Many of these newfangled experiences that are being brought to market require powerful hardware in the cloud, and NVIDIA's gamble on the data center continues to pay off enormously.

"The next industrial revolution has begun—companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center—AI factories—to produce a new commodity: artificial intelligence," said Jensen Huang, founder and CEO of NVIDIA. "AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities."

Indeed, revenue opportunities abound and NVIDIA is cashing in at unprecedented levels. That $26 billion in quarterly revenue is a record high for NVIDIA, driving record sales in the data center, which checked in at $22.6 billion for the quarter. That's a 23% gain sequentially and a monster 427% jump from a year ago.

Gaming is now a distant second behind the data center, though don't mistake that for being insignificant. It accounted for nearly $2.7 billion in the first quarter, which is down 8% sequentially but up 18% year-over-year. While it's no longer NVIDIA's bread and butter, it's still a lucrative business. NVIDIA chalked up the sequential decline in Gaming due to seasonal GPU sales trends, while noting that the year-on-year spike mostly reflects higher demand for its GeForce products.

Meanwhile, NVIDIA also saw yearly gains in its Professional Visualization ($427 million, up 45%), Automotive ($329 million, up 11%), and OEM and Other ($78 million, up 1%) divisions.

During an earnings call, NVIDIA's executive vice president and chief financial officer Colette Kress stated that "inference drove about 40% our data center revenue" in the company's trailing quarters," adding that "both training and inference are growing significantly."

"As generative AI makes its way into more consumer Internet applications, we expect to see continued growth opportunities as inference scales both with model complexity as well as with the number of users and number of queries per user, driving much more demand for AI compute," Kress said.

"These next-generation data centers host advanced full-stack accelerated computing platforms where the data comes in and intelligence comes out. In Q1, we worked with over 100 customers building AI factories ranging in size from hundreds to tens of thousands of GPUs, with some reaching 100,000 GPUs," Kress added.

Looking ahead, NVIDIA went on record saying its next-generation Blackwell architecture will deliver a "giant leap with up to 25x lower TCO energy consumption" compared to its legacy Hopper products that are shipping now. That basically means NVIDIA is in a strong position to keep its momentum going.

"The demand for GPUs in all the data centers is incredible. We're racing every single day. And the reason for that is because applications like ChatGPT and GPT-4o, and now it's going to be multi-modality and Gemini and its ramp and Anthropic and all of the work that's being done at all the CSPs are consuming every GPU that's out there," Huang added.

NVIDIA also

announced a ten-for-one split of its common stock in an effort to make shares of the company more accessible to both employees and investors. At the time of this writing, NVIDIA's share price is $1,037, so a ten-for-one split means the share price would be $103.70, based on the current price. Additionally, each current holder of common stock will receive nine additional shares when when the split takes place at the close of market on Thursday, June 6, 2024.