The PC market is approaching two years' worth of quarterly shipment declines in the global PC market, with IDC and Gartner—the two major market research firms with a pulse on the PC shipment landscape—reporting double-digit percentage drops (

again). It's not all gloom and doom, though, as the market performed better than expected and showed signs stabilizing.

According to IDC, worldwide PC shipments declined 13.4% year-over-year to 61.6 million units during the second quarter of 2023. The firm blamed the "poor showing" weak demand from both the consumer and commercial sectors, and a shift in IT budgets away from device purchases (unlike in 2020 when PC shipments

smashed a 10-year growth record). This caused inventory levels to remain elevated longer than expected.

"The roller coaster of supply and demand the PC industry has faced over the past five years has been extremely challenging," said Ryan Reith, group vice president for IDC's Client Device Trackers. "Companies don't want to be caught with short supply like they were in 2020 and 2021, but at the same time, many seem hesitant to make the big bet on a market rebound.

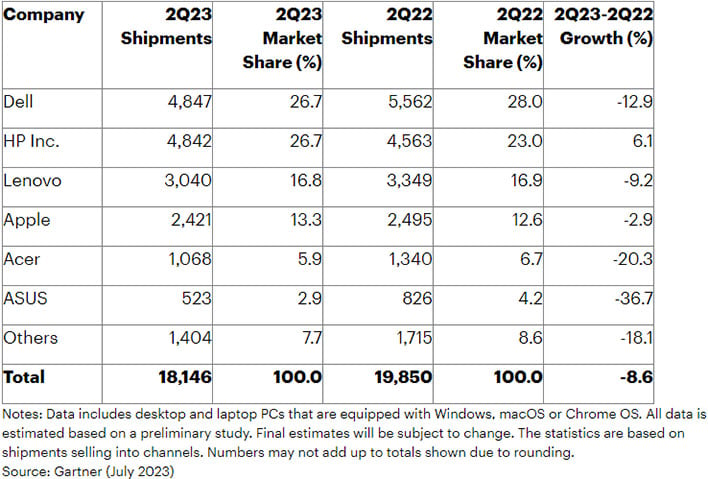

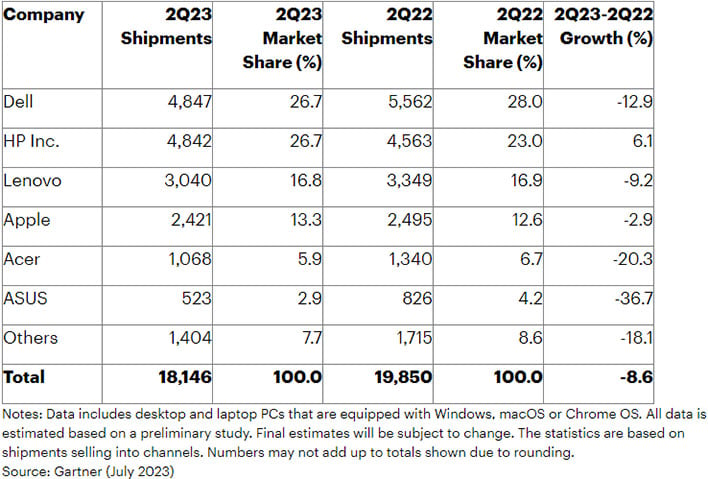

Gartner offered up similar analysis saying shipments decreased 16.6% to 59.7 million units, but was a bit more optimistic saying the PC market is "showing initial signs of stabilization" after a brutal seven consecutive quarters of year-over-year declines.

"The rate of decline in the PC market has slowed, indicating that shipment volumes may have reached their lowest point," said Mikako Kitagawa, Director Analyst at Gartner. "There has been progress in reducing PC inventory after more than a year of issues, supported by a gradual increase in business PC demand. Gartner expects that PC inventory will normalize by the end of 2023, and PC demand will return to growth starting in 2024."

At a glance, Apple and HP appear to have been the big winners last quarter, as they're the only two that showed a low or no drop in shipment growth. According to IDC, Apple increased its shipments by 10.3% to 5.3 million units, while HP fell just 0.8% to 13.4 million units. Meanwhile, every other PC maker saw double-digit declines, including Lenovo (down 18.4%), Dell (down 22%), and Acer (down 16.5%).

Meanwhile, Gartner pegged Apple and HP as having declined 0.3% and 0.9%, respectively, versus double-digit drops for all others (20.8% for Lenovo, 21.8% for Dell, 21.1% for Acer, and 17.3% for ASUS). So somewhat different numbers across the board, but they tell the same story.

Everyone must be flocking to Apple and HP then, right? Not so fast. IDC has Lenovo's 2Q shipment tally at 14.2 million units, giving it the largest market share (23.1%) of the bunch. HP came in second at 13.4 million, Dell in third at 10.3 million, Apple in fourth at 5.3 million, and Acer in fifth at 4 million. All others accounted for 14.4 million combined.

Gartner had the same market share ranking and similar shipment figures for Lenovo at a little over 14.3 million for a 24% share of the market, versus 22.5% for HP and 8.9% for Apple.

The real winner in all this, though, is the consumer.

"Elevated channel and component inventory are once again dragging down the market," said Jitesh Ubrani, research manager for IDC's Mobility and Consumer Device Trackers. "And despite these issues slowly easing, many component suppliers continue to offer reduced pricing in an effort to clear their inventory though PC makers and channels are still cautious about new systems due to the reduced demand."

The takeaway is that it's a great time to be in the market for a new or upgraded PC, whether it's a prebuilt machine or a self-assembled rig.