With Broadcom's Exit, Qualcomm Now The Uncontested LTE Modem Champion

This week, Broadcom announced that it would exit the LTE modem market and shut down its LTE research division. The move comes less than a year after Broadcom bought Renesas' (formerly known as NEC) LTE modem -- and that purchase was supposed to give Broadcom a leg up in modem design after its own in-house LTE product had failed to ship.

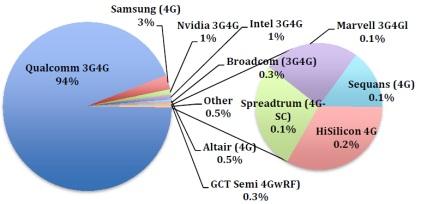

With Broadcom gone, Qualcomm is, for all intents and purposes, the Emperor of LTE mountain. The market shift has happened quickly -- look at where revenue share sat in 2009, when 4G was still on the horizon and 3G modems were the norm.

Qualcomm is still the leading provider, no question, but ST-Ericsson, Texas Instruments, MediaTek, and Infineon all have respectable pieces of the pie. Even Infineon (now owned by Intel) had a wireless business worth roughly $880M -- not exactly chump change. By 2012, Qualcomm had 86% of the combined 3G/4G LTE market. By Q1 2013, the last data I could find, it held 94%.

Today, there's simply no competition shipping in the market. Intel's XMM 7160 (40nm LTE) didn't support a full suite of modern features and only shipped in a handful of devices. The XMM 7260, which was supposed to be shipping in volume in Q3 of this year, has been pushed back due to qualification issues and is now expected to ramp in volume only in Q1 2015. By then, Intel's 28nm stand-alone radio will be competing against Qualcomm's 20nm SoCs (the company's 20nm Gobi 9x35 radio has been shipping in volume for months).

The XMM 7260's baseband, meanwhile, is still built on 65nm technology, compared to 20nm for Qualcomm. We don't have power consumption figures for how those two match up -- all I'll note is that high-powered RF circuits are much, much harder to scale to smaller process nodes. The gap between 65nm and 20nm in traditional CPUs is enormous, but the power consumption difference between Qualcomm's 20nm Gobi and Intel's 65nm baseband may be much smaller.

Even so, the company is now in a position to continue to dominate the LTE market. With Broadcom gone (the company will lay off 2500 employees as part of closing this business unit), there's hardly anyone even working on next-gen modems. The field has shrunk to Intel, Qualcomm, and a tiny slice of space for companies like ST-Ericsson and Nvidia -- the latter's software-defined Icera modem is presumably inside the Shield Tablet, but NV hasn't explicitly confirmed that.

In short, Qualcomm appears to have locked up all the revenue in next-generation modem technology -- and to be a full node ahead of Intel, its closest competitor.

With Broadcom gone, Qualcomm is, for all intents and purposes, the Emperor of LTE mountain. The market shift has happened quickly -- look at where revenue share sat in 2009, when 4G was still on the horizon and 3G modems were the norm.

Qualcomm is still the leading provider, no question, but ST-Ericsson, Texas Instruments, MediaTek, and Infineon all have respectable pieces of the pie. Even Infineon (now owned by Intel) had a wireless business worth roughly $880M -- not exactly chump change. By 2012, Qualcomm had 86% of the combined 3G/4G LTE market. By Q1 2013, the last data I could find, it held 94%.

Today, there's simply no competition shipping in the market. Intel's XMM 7160 (40nm LTE) didn't support a full suite of modern features and only shipped in a handful of devices. The XMM 7260, which was supposed to be shipping in volume in Q3 of this year, has been pushed back due to qualification issues and is now expected to ramp in volume only in Q1 2015. By then, Intel's 28nm stand-alone radio will be competing against Qualcomm's 20nm SoCs (the company's 20nm Gobi 9x35 radio has been shipping in volume for months).

The XMM 7260's baseband, meanwhile, is still built on 65nm technology, compared to 20nm for Qualcomm. We don't have power consumption figures for how those two match up -- all I'll note is that high-powered RF circuits are much, much harder to scale to smaller process nodes. The gap between 65nm and 20nm in traditional CPUs is enormous, but the power consumption difference between Qualcomm's 20nm Gobi and Intel's 65nm baseband may be much smaller.

Even so, the company is now in a position to continue to dominate the LTE market. With Broadcom gone (the company will lay off 2500 employees as part of closing this business unit), there's hardly anyone even working on next-gen modems. The field has shrunk to Intel, Qualcomm, and a tiny slice of space for companies like ST-Ericsson and Nvidia -- the latter's software-defined Icera modem is presumably inside the Shield Tablet, but NV hasn't explicitly confirmed that.

In short, Qualcomm appears to have locked up all the revenue in next-generation modem technology -- and to be a full node ahead of Intel, its closest competitor.