Intel Plans Full Court Press In Tablets As PC Market Stabilizes

The PC market has tumbled throughout the past 18 months, but Intel believes the worst of the decline is over -- and that the tablet market is poised to boom. At its Analyst Day today, the company forecast stable PC sales through 2014, with gains in the market driven by an estimated 4x increase in tablet sales. And make no mistake -- Intel wants to be in those devices.

What a difference a few years makes

The Asus Transformer Book T100 has transformed my view of how useful x86 devices can be in the $400 market. True, it has some flaws -- the power adapter is extremely slow to charge the device -- but on the whole, it's absolutely functional for basic traveling and work. Convertibles like this blur the line between tablet and laptop but they blur it in the best possible way -- by offering a device that's equally good at both roles, not a half-baked compromise between them.

Bay Trail's increased performance, meanwhile, means that while you'll never mistake the T100 for a high-end Haswell, it lacks the teeth-grinding slowness of first-gen netbooks. Intel wants to drive new experiences on both Android and Windows, and we see that goal reflected in pricing. Systems that cost $600-$800 with Clover Trail 12 months ago are now shipping with Bay Trail today, and at $350 - $450.

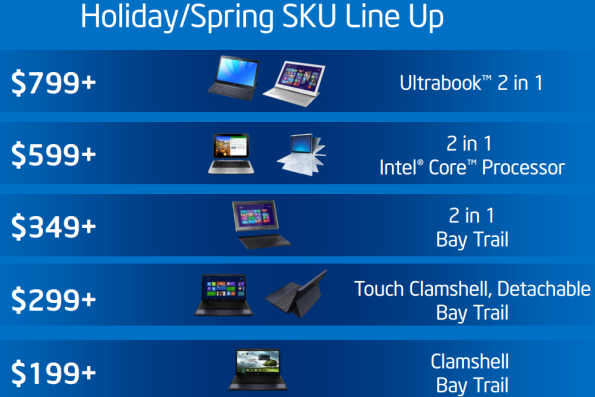

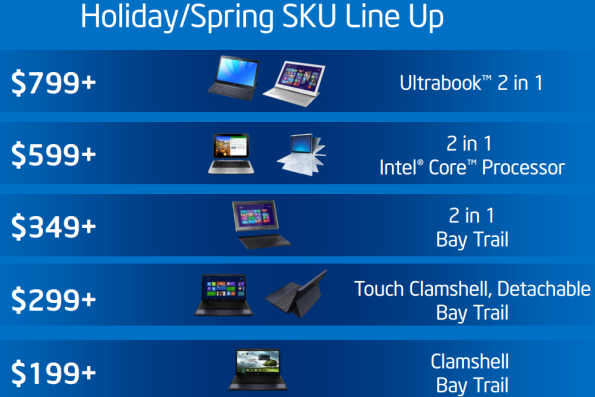

Granted, ARM isn't sitting still. We're still going to see determined competition from ARM vendors like Qualcomm, Apple, and Nvidia. Intel's slide below is a bit cherry picked, as it doesn't include figures from Surface 2, where NV would compete more effectively. Still, Intel is promising to drive competition to even lower price points with Bay Trail, with a holiday lineup of hardware hitting as low as $199.

Whether it hits this point exactly is still up for discussion, but it's worth noting how different this is from a few years ago, when WinRT systems were being talked about as the "budget" option, while x86 Clover trail and Core chips would deliver the higher end solution. The attitude is gone now, swept out by the reality of hard figures. WIth consumers shifting buying to tablets faster than Intel expected, Intel has to make certain it's in the Windows and Android devices that customers want to buy, at every price point.

That means the pressure is on Bay Trail, the upcoming phone platform, Merrifield, and the Airmont platform that'll drop in 2014, side-by-side with the new Cherry Trail graphics core. That GPU is a huge step up from Bay Trail -- Cherry Trail will pack 16 EUs to BT's 4, include the same 8th-generation advances as Broadwell, and should be far more powerful than anything currently on the market. Another Intel slide indicates that by 2015, Intel intends to have "Performance" options ready based on Atom as well as Core.

Fitting Ivy Bridge graphics into a small mobile chip like Atom would be a huge step forward for graphics performance in this segment, even if it wouldn't compete well with truly high-end chips. A core that powerful, however, could plausibly handle the kind of low-end gaming Intel chips of this year could run themselves -- but in 20-30% the power envelope.

What a difference a few years makes

The Asus Transformer Book T100 has transformed my view of how useful x86 devices can be in the $400 market. True, it has some flaws -- the power adapter is extremely slow to charge the device -- but on the whole, it's absolutely functional for basic traveling and work. Convertibles like this blur the line between tablet and laptop but they blur it in the best possible way -- by offering a device that's equally good at both roles, not a half-baked compromise between them.

Bay Trail's increased performance, meanwhile, means that while you'll never mistake the T100 for a high-end Haswell, it lacks the teeth-grinding slowness of first-gen netbooks. Intel wants to drive new experiences on both Android and Windows, and we see that goal reflected in pricing. Systems that cost $600-$800 with Clover Trail 12 months ago are now shipping with Bay Trail today, and at $350 - $450.

Granted, ARM isn't sitting still. We're still going to see determined competition from ARM vendors like Qualcomm, Apple, and Nvidia. Intel's slide below is a bit cherry picked, as it doesn't include figures from Surface 2, where NV would compete more effectively. Still, Intel is promising to drive competition to even lower price points with Bay Trail, with a holiday lineup of hardware hitting as low as $199.

Whether it hits this point exactly is still up for discussion, but it's worth noting how different this is from a few years ago, when WinRT systems were being talked about as the "budget" option, while x86 Clover trail and Core chips would deliver the higher end solution. The attitude is gone now, swept out by the reality of hard figures. WIth consumers shifting buying to tablets faster than Intel expected, Intel has to make certain it's in the Windows and Android devices that customers want to buy, at every price point.

That means the pressure is on Bay Trail, the upcoming phone platform, Merrifield, and the Airmont platform that'll drop in 2014, side-by-side with the new Cherry Trail graphics core. That GPU is a huge step up from Bay Trail -- Cherry Trail will pack 16 EUs to BT's 4, include the same 8th-generation advances as Broadwell, and should be far more powerful than anything currently on the market. Another Intel slide indicates that by 2015, Intel intends to have "Performance" options ready based on Atom as well as Core.

Fitting Ivy Bridge graphics into a small mobile chip like Atom would be a huge step forward for graphics performance in this segment, even if it wouldn't compete well with truly high-end chips. A core that powerful, however, could plausibly handle the kind of low-end gaming Intel chips of this year could run themselves -- but in 20-30% the power envelope.