Intel's 14nm Broadwell Production Throws Down Gauntlet For Major Semiconductor Competitors In Mobile

If Intel's recent 14nm Broadwell Y unveil has made anything clear, it's that the company is now determined to go toe-to-toe with every foundry manufacturer at the 14nm node.

It wasn't initially clear if this would be the case. While Intel made a big splash with its first 14nm announcements, news of the delays and a robust rebuttal from TSMC concerning the health and capability of its own 20nm and 16nm offerings made it seem as though Intel might have been rocked back on its heels and fighting a defensive front.

Where other semiconductor manufacturers have openly acknowledged the end of Moore's law's cost scaling (meaning 20nm and 16nm silicon is expected to be more expensive than previous generations), Intel is claiming historic scaling. That's a huge difference, if it's true.

Intel Claims Multiple 14nm Advantages:

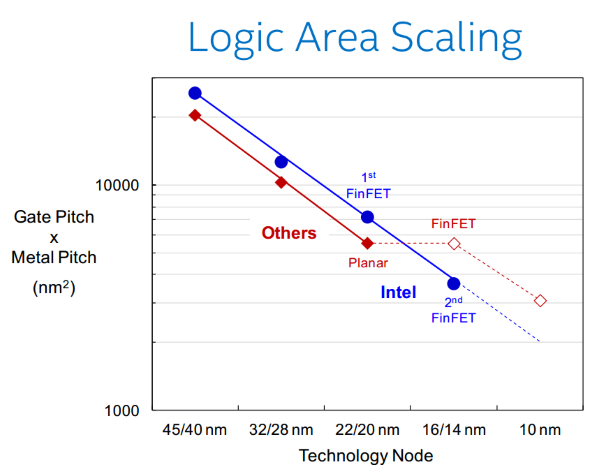

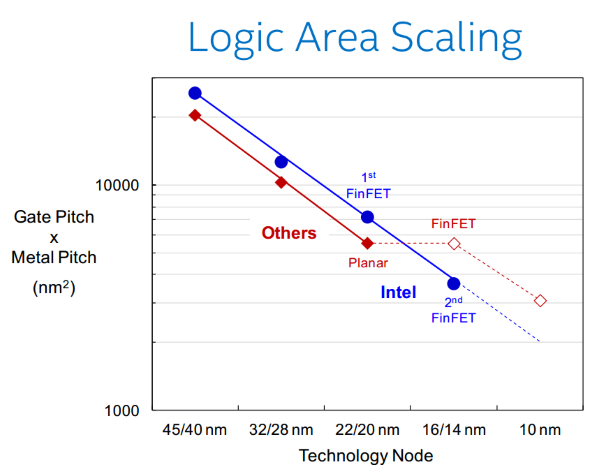

Intel is claiming that TSMC, GF, and Samsung will have to collectively pause below 20nm, re-tune for FinFET, and only then begin scaling downwards once again. As far as we're aware, that's true -- TSMC and GlobalFoundries both forecast only modest improvements for die size and density at 20nm.

The FinFET transition, meanwhile, isn't going to deliver a huge advantage in <em>scaling</em> for either company. Every major foundry has announced plans to combine a 14/16nm front-end process with FinFETs with a back-end 20nm technology line. That doesn't mean power and performance won't improve at these future nodes, but any density improvements will come from re-architecting SoCs to run with FinFET technology -- not intrinsic die shrinks.

One notable caveat here is that the complexity of SoCs makes it incredibly easy to shift how "Logic area" scaling graphs between two different companies. Performance also isn't considered here -- all of which means we'd take these graphs with grains of salt.

What Intel is doing in aggregate, however, is throwing down a gauntlet in front of the other foundries and arguing for the superiority of its own technology. Now that Intel is beginning to dip its toes into the foundry business and pulling in business from customers like Panasonic, the company's expertise has become a somewhat larger threat. Intel isn't looking to become a dedicated pure-play foundry, but it's definitely interested in capturing a set of halo customers for itself, and data like this is what Chipzilla hopes will attract them.

A Potential Game-Changer -- if Intel Can Deliver

If Intel's 14nm really delivers like the company says it will with Broadwell Y, this could be the tablet chip that establishes big-core Broadwell as ready to compete with the upcoming set of 64-bit ARM processors. That's a huge potential advantage for Intel -- but there are some really big "ifs" attached to that statement.

It's worth noting that thus far, nothing in the ARM vs. x86 space has played out the way we thought it would three years ago. Windows RT has gone from being seen as a "must-have" for Microsoft to an albatross. The "smartbook" systems that Qualcomm and other ARM vendors predicted would chew into low-end Windows notebook share never really emerged. Instead of facing off against each other with knives drawn, ARM and x86 have dropped into parallel tracks, with Intel barely making a dent in the Android market and ARM all but absent from the Windows / x86 space.

Either way, however, Intel is sending signals. Broadwell Y is the chip that'll take the fight into ARM's backyard -- and Intel's foundry business is gearing up to take on the pure-play manufacturers more directly.

It wasn't initially clear if this would be the case. While Intel made a big splash with its first 14nm announcements, news of the delays and a robust rebuttal from TSMC concerning the health and capability of its own 20nm and 16nm offerings made it seem as though Intel might have been rocked back on its heels and fighting a defensive front.

Where other semiconductor manufacturers have openly acknowledged the end of Moore's law's cost scaling (meaning 20nm and 16nm silicon is expected to be more expensive than previous generations), Intel is claiming historic scaling. That's a huge difference, if it's true.

Intel Claims Multiple 14nm Advantages:

Intel is claiming that TSMC, GF, and Samsung will have to collectively pause below 20nm, re-tune for FinFET, and only then begin scaling downwards once again. As far as we're aware, that's true -- TSMC and GlobalFoundries both forecast only modest improvements for die size and density at 20nm.

The FinFET transition, meanwhile, isn't going to deliver a huge advantage in <em>scaling</em> for either company. Every major foundry has announced plans to combine a 14/16nm front-end process with FinFETs with a back-end 20nm technology line. That doesn't mean power and performance won't improve at these future nodes, but any density improvements will come from re-architecting SoCs to run with FinFET technology -- not intrinsic die shrinks.

One notable caveat here is that the complexity of SoCs makes it incredibly easy to shift how "Logic area" scaling graphs between two different companies. Performance also isn't considered here -- all of which means we'd take these graphs with grains of salt.

What Intel is doing in aggregate, however, is throwing down a gauntlet in front of the other foundries and arguing for the superiority of its own technology. Now that Intel is beginning to dip its toes into the foundry business and pulling in business from customers like Panasonic, the company's expertise has become a somewhat larger threat. Intel isn't looking to become a dedicated pure-play foundry, but it's definitely interested in capturing a set of halo customers for itself, and data like this is what Chipzilla hopes will attract them.

A Potential Game-Changer -- if Intel Can Deliver

If Intel's 14nm really delivers like the company says it will with Broadwell Y, this could be the tablet chip that establishes big-core Broadwell as ready to compete with the upcoming set of 64-bit ARM processors. That's a huge potential advantage for Intel -- but there are some really big "ifs" attached to that statement.

It's worth noting that thus far, nothing in the ARM vs. x86 space has played out the way we thought it would three years ago. Windows RT has gone from being seen as a "must-have" for Microsoft to an albatross. The "smartbook" systems that Qualcomm and other ARM vendors predicted would chew into low-end Windows notebook share never really emerged. Instead of facing off against each other with knives drawn, ARM and x86 have dropped into parallel tracks, with Intel barely making a dent in the Android market and ARM all but absent from the Windows / x86 space.

Either way, however, Intel is sending signals. Broadwell Y is the chip that'll take the fight into ARM's backyard -- and Intel's foundry business is gearing up to take on the pure-play manufacturers more directly.