AMD Announces 64-bit ARM Server Partnership; Proclaims "Seminal Moment" in Computing

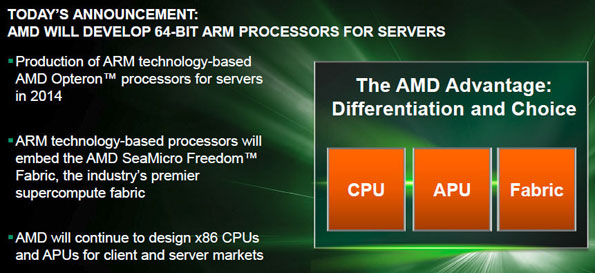

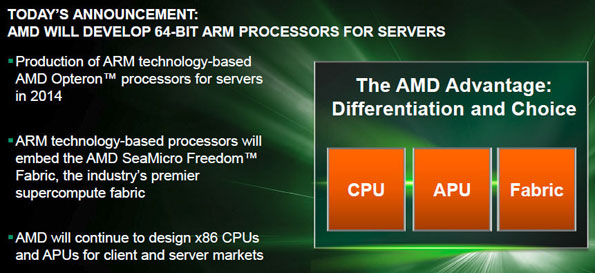

AMD CEO Rory Read has announced that the company intends to develop dense computing platforms based on the 64-bit ARM architecture today. This is the second major collaboration between AMD and ARM; Sunnyvale announced earlier this year that it would integrate an ARM core to provide additional hardware-level security on future APUs.

The meat of AMD's announcement today is that it's going to leverage the SeaMicro acquisition of earlier this year to ensure it has a platform for its own products. SeaMicro's Freedom Fabric virtualizes a great deal of technology that's normally built into hardware on a typical motherboard and reportedly saves a great deal of power and improves server density by doing so.

It's an announcement that raises as many questions as it answers. The good news is that AMD is scarcely alone in eyeing the ARM server market; there are a number of companies considering whether such a move makes good sense for them, as well. The 64-bit ARMv8 architecture looks solid, and low power is a hot market in every segment.

But it's hard to ignore the fact that AMD already has a low-power architecture. 40nm Brazos may not be much of a competitor against a hypothetical ARM server, but the chip's 28nm Kabini refresh and Jaguar core have been billed as offering significantly improved power consumption alongside a 15% IPC improvement.

AMD's presentation claims that the secret to the company's resurgence into servers is going to be driven by SeaMicro's fabric, but if that's the case, it doesn't answer why ARM is a better option than AMD's own in-house technology. It also doesn't explain why AMD maintains that it'll be the only company shipping ARM and x86 servers, as opposed too ARM and Opteron. Is that significant, given the imminent announcement of 15% of the company? We honestly don't know. It's possible that AMD is only referring to the fact that SeaMicro continues to sell Xeon processors. The market continues to be uncertain about such developments because Read has made it clear that he's considering cuts and company repositions that were unthinkable two years ago -- but is tight-lipped about what, exactly, such transitions will entail.

The Elephant in the Room:

Watching AMD's disclosure is frustrating because it feels like the company is constantly dodging the most important questions. The company waxes rhapsodic on the importance of data center power consumption, optimized CPU interconnects, multi-core data sharing, and the ability to scale current technology to meet the demands of future supercomputers -- and it's all true.

ARM in the data center? That's interesting -- but with AMD's stock currently priced at $2.07, investors are a lot more concerned with whether or not the company can make it to launch day as a going concern. It's one thing to identify the major factors in play in the current market and something else entirely to position the company to take advantage of them. If SeaMicro's fabric was truly that game-changing, it's hard to imagine that the likes of Intel, HP, and Dell wouldn't have snapped the company up before AMD came along.

What AMD needs to do, if it wants to reassure investors and repair its stock price, is issue concrete launch dates and performance/TDP targets for Kabini, Kaveri, and this new ARMv8 64-bit product. Sunnyvale needs to clarify whether it intends to launch Steamroller as a CPU and APU as it did for Trinity/Vishera, or if it plans to shift all of its non-server products to APUs in 2013-2014.

So long as Read and Company dodge this topic, the company is going to stay mired in the doldrums. Dirk Meyer's tenure as CEO was obviously marked by missteps, but he repaired Wall Street's confidence by setting realistic, concrete roadmaps and then hitting those targets for several years running. AMD's road back to profitability -- assuming one exists -- starts with such transparency.

The meat of AMD's announcement today is that it's going to leverage the SeaMicro acquisition of earlier this year to ensure it has a platform for its own products. SeaMicro's Freedom Fabric virtualizes a great deal of technology that's normally built into hardware on a typical motherboard and reportedly saves a great deal of power and improves server density by doing so.

It's an announcement that raises as many questions as it answers. The good news is that AMD is scarcely alone in eyeing the ARM server market; there are a number of companies considering whether such a move makes good sense for them, as well. The 64-bit ARMv8 architecture looks solid, and low power is a hot market in every segment.

But it's hard to ignore the fact that AMD already has a low-power architecture. 40nm Brazos may not be much of a competitor against a hypothetical ARM server, but the chip's 28nm Kabini refresh and Jaguar core have been billed as offering significantly improved power consumption alongside a 15% IPC improvement.

AMD's presentation claims that the secret to the company's resurgence into servers is going to be driven by SeaMicro's fabric, but if that's the case, it doesn't answer why ARM is a better option than AMD's own in-house technology. It also doesn't explain why AMD maintains that it'll be the only company shipping ARM and x86 servers, as opposed too ARM and Opteron. Is that significant, given the imminent announcement of 15% of the company? We honestly don't know. It's possible that AMD is only referring to the fact that SeaMicro continues to sell Xeon processors. The market continues to be uncertain about such developments because Read has made it clear that he's considering cuts and company repositions that were unthinkable two years ago -- but is tight-lipped about what, exactly, such transitions will entail.

The Elephant in the Room:

Watching AMD's disclosure is frustrating because it feels like the company is constantly dodging the most important questions. The company waxes rhapsodic on the importance of data center power consumption, optimized CPU interconnects, multi-core data sharing, and the ability to scale current technology to meet the demands of future supercomputers -- and it's all true.

ARM in the data center? That's interesting -- but with AMD's stock currently priced at $2.07, investors are a lot more concerned with whether or not the company can make it to launch day as a going concern. It's one thing to identify the major factors in play in the current market and something else entirely to position the company to take advantage of them. If SeaMicro's fabric was truly that game-changing, it's hard to imagine that the likes of Intel, HP, and Dell wouldn't have snapped the company up before AMD came along.

What AMD needs to do, if it wants to reassure investors and repair its stock price, is issue concrete launch dates and performance/TDP targets for Kabini, Kaveri, and this new ARMv8 64-bit product. Sunnyvale needs to clarify whether it intends to launch Steamroller as a CPU and APU as it did for Trinity/Vishera, or if it plans to shift all of its non-server products to APUs in 2013-2014.

So long as Read and Company dodge this topic, the company is going to stay mired in the doldrums. Dirk Meyer's tenure as CEO was obviously marked by missteps, but he repaired Wall Street's confidence by setting realistic, concrete roadmaps and then hitting those targets for several years running. AMD's road back to profitability -- assuming one exists -- starts with such transparency.